When an aircraft is financed or leased, the lessor/financier and the lessee/borrower will document their agreed legal right to enforce the interests they have in the aircraft. This is an Aircraft Security Agreement. An important aspect of a mortgage is that it allows the lender or creditor to retain rights over the aircraft in the event of default while still allowing it to be used according to the agreement.

Because the Aircraft Security Agreement is filed in the Federal Aviation Administration registry, it provides public notice of that security interest, thus helping prevent disputes arising between competing creditors and protecting lenders against loss. The agreement lets the borrower finance the aircraft later without giving up possession. Buyers sell, lenders lend, aviation investors invest. They need to understand the structure of the agreement.

This guide covers the background to, legal basis of, comparison and practicalities of an Aircraft Security Agreement.

Overview of an Aircraft Security Agreement

An Aircraft Security Agreement is an agreement between the borrower, as owner of an aircraft, and a secured party, as lender, to create a security interest in the aircraft to secure a loan given on that aircraft.

Key Purposes of the Agreement

- Secures Financing: Enables owners to borrow money against the aircraft for collateral.

- Protects Lenders: Ensures repayment or recovery of the aircraft in case of default.

- Provides Transparency: FAA recordation makes the rights a matter of public record.

- Aviation Transactions: Loans, leases, or equity investment in aircraft.

| Feature | Description | Benefit |

| Borrower’s Role | Uses aircraft while loan is active | Retains operational control |

| Lender’s Rights | Holds legal interest until repayment is complete | Reduces financial risk |

| FAA Recordation | Security interest filed with FAA | Public notice of lender’s rights |

| Allows Default Protection | Lender to repossess in event of nonpayment | Protects creditor investments |

This helps secure the borrower’s access to financing and the lender’s right to recovery.

Legal and Regulatory Aspects of Aircraft Security Agreements

Aircraft security interests are highly regulated due to the value and mobility of aircraft.

FAA Recordation

For the agreement to be enforceable, it must be filed with the FAA Aircraft Registry. Essential details include:

- Aircraft registration number.

- Complete details of the borrower and lender.

- Loan terms and obligations.

- Signatures of both parties.

Priority and Enforceability

Therefore, once the lender’s interest is recorded, that claim takes priority over any later claims and any later debts or liens.

International Recognition

Some international aircraft may be subject to the Cape Town Convention, to ensure international recognition of security rights in the aircraft.

Comparing Aircraft Security Agreements with Similar Instruments

Although other aviation financial instruments exist, the Aircraft Security Agreement has its own advantages.

Aircraft Security Agreement vs. Aircraft Mortgage

- Security Agreement: More general; secures loans, leases or other types of obligations.

- Mortgage: Specifically tied to repayment of a loan.

Aircraft Security Agreement vs. UCC Filings

- Security Agreement: Filed with FAA for aviation-specific collateral.

- Mortgage: Mostly a loan repayment obligation.

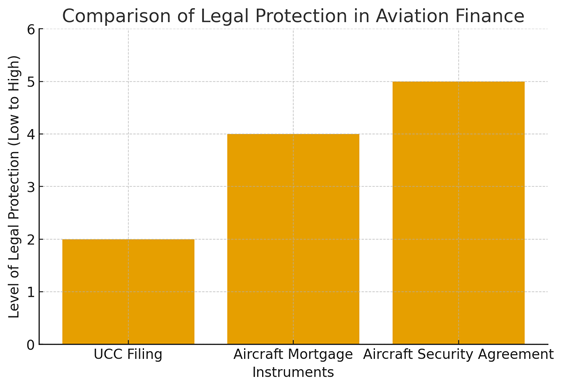

- Aircraft Security Agreement provides the highest level of legal protection in aviation finance.

- Aircraft Mortgage offers strong but slightly lower protection compared to agreement.

- UCC Filing gives moderate legal protection, mainly covering general commercial interests.

Borrowers and lenders should follow a structured process to ensure validity.

Draft the Agreement

Include aircraft details, loan terms, borrower obligations, and lender rights.

Execute the Contract

The borrower and lender both sign on the agreement. Witnesses must be present at the signing.

File with FAA Registry

Submit the agreement to the FAA for official recordation.

Maintain Compliance

Borrowers are required to repay the debt under the terms, lenders have rights until the loan is paid.

The Importance of an Aircraft Security Agreement

At National Aviation Center, the Aircraft Security Agreement underlies aircraft secured transactions, protecting lenders, extending secured credit to borrowers, leasing specific operational aircraft, and providing clarity and certainty in airplane ownership through the FAA’s registration of a secured party’s interest.

Compared with other instruments, it offers the best balance of borrower and lender needs. To buyers, lenders, and aviation investors, doing it right means smooth transactions and financial security.

If all procedural steps have been taken, all parties should be protected, and the transaction of the aircraft can be completed.