Buying an aircraft through a loan is a huge step that requires meticulous planning and the need for legal protection. One of the most essential means in aviation finance is the Aircraft Mortgage. This legal document lets the creditors safeguard their interest in an aircraft thereby guaranteeing their money while empowering buyers to finance such a big purchase in a responsible way.

The Aircraft Mortgage is the main instrument that marries the owners’ rights with the lender’s safeguards. By filing with the FAA, it puts on record the lender’s interest, thus providing a disclosed view to subsequent buyers, investors, and creditors. So, for both owners of aircraft and banks, it is a must to know the working of this mortgage for an easy way to evade conflicts, ensure legality, and safeguard their financial interests.

What Is an Aircraft Mortgage and Why It Matters

An Aircraft Mortgage is a type of security deal that gives the lender a legal share of the aircraft, thus it is the borrower’s responsibility to return the money borrowed. Such an agreement is also filed with the FAA, allowing the holder of the mortgage to have their rights secured by the public record.

Key Benefits of Aircraft Mortgages

- Legal Protection for Lenders: complies with the borrower’s obligation by substantively ‘pledging’ the loan with the aircraft embodied.

- Access to Financing for Buyers: the buyers, be it single persons or companies, are allowed to get hold of the luxury jets of over a million dollars via installments rather than paying the full amount on-the-spot to own the aircraft.

- Public Transparency: through the FAA registration, mortgage info is easily accessible not only to future buyers but also to lenders.

- Priority in Claims: Registered mortgages provide lenders with priority over unrecorded claims.

| Feature | Description | Benefit for Owners & Lenders |

| Legal Agreement | Secures debt with aircraft as collateral | Protects lender’s investment |

| FAA Registration | Mortgage recorded in FAA Registry | Provides public notice |

| Borrower’s Rights | Retains use of aircraft during repayment | Allows business continuity |

| Lender’s Rights | Can repossess aircraft if borrower defaults | Reduces financial risk |

By combining financing flexibility with legal safeguards, aircraft mortgages support a secure aviation marketplace.

Legal and Regulatory Aspects of Aircraft Mortgages

The loan that was given to the plane has to be in line with the federal aviation law, and if it is approved, it also has to comply with the regulations of the local authorities about the financing of the aircraft.

A ‘power of attorney’ conforming to the FAA requirements must be delivered to the FAA.

The main things the document describe and include are:

- The identification number of the aircraft.

- Names of the borrower and the lender.

- The amount of the debt and the terms for its repayment.

Signatures and acknowledgments of the Aircraft Mortgage

As soon as the mortgage is recorded, it becomes legally binding and gives third parties a notice.

Priority Rules

Registered mortgages hold priority over subsequent claims. This protects lenders from later disputes if the borrower defaults.

International Considerations

For aircraft involved in international transactions, additional filings under the Cape Town Treaty may be required, ensuring recognition of rights beyond U.S. borders.

Comparing Aircraft Mortgages with Other Financing Tools

An Aircraft Mortgage is generally the most effective way to safely obtain a loan, however, there are other financing tools in place.

Mortgage vs. Lease

Aircraft Mortgage: The owner of the aircraft will be the one who took the loan but will be accountable under the repayment terms.

Aircraft Lease: The ownership will transfer to the leaseholder after the termination of the lease.

Mortgage vs. UCC Financing

Mortgage: A public record filed with the Federal Aviation Administration, a direct security interest in the aircraft.

UCC Filing: A notice of a security interest in an asset or assets of a debtor which are not necessarily aviation-specific personal property.

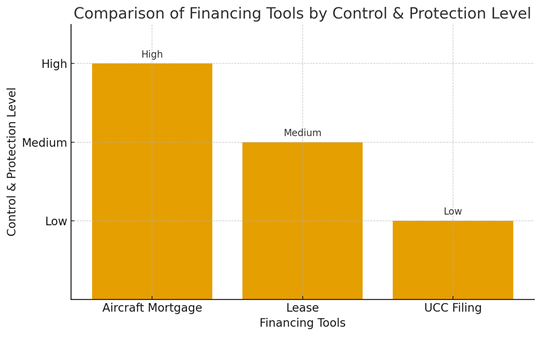

- Aircraft Mortgage provides the highest level of control and protection.

- Lease offers a moderate or medium level of protection.

- UCC Filing provides the lowest level of protection among the three tools.

This shows why mortgages are preferred in aviation: they combine borrower flexibility with lender security.

Practical Guide: How to Secure an Aircraft Mortgage

Getting an aircraft mortgage is a process that requires the readiness of the parties involved and abiding by the requirements of the Federal Aviation Administration (FAA).

Evaluate Financing Needs – Aircraft Mortgage

Figure out if it is necessary to buy on credit and if such a purchase would be sustainable in the long run based on available finances.

Negotiate Loan Terms

Come to an understanding with the bank on how the money will be paid back, the interest rates, and the rights in case of non-compliance.

Draft the Aircraft Mortgage Agreement

Include aircraft details, loan terms, and security agreements. Legal review is highly recommended.

File with the FAA Registry

Submit the mortgage for official recordation, ensuring it becomes enforceable and visible to the public.

Maintain Compliance

Stay current on payments and update the FAA if ownership or financing terms change.

The Value of an Aircraft Mortgage

The Aircraft Mortgage is really one of the most important things in the aircraft financing sector, as it allows the purchaser to access such an expensive item as an aircraft without worrying that the seller will be at risk due to which the aircraft will be repossessed. National Aviation Center offers the parties involved in a transaction the feeling of security, it gives public transparency and legal certainty to both parties in their transaction.

By no means is the Aircraft Mortgage from the perspective of an aviation financial product a typical general financing tool since it is a special balance that is struck between the borrower’s right to refrain and the lender’s right to be protected by giving them an aircraft mortgage which upon registration with the FAA and compliance with federal requirements confers the rights and decreases the risks for them.

Any person who is in the business of buying or selling an aircraft should acquaint himself with the Aircraft Mortgage in order to have trouble-free transactions and financial stability in the long run.