Once the loan for the aircraft is paid off, the borrower expects to own the aircraft free from any lien or other legal claims by the lender. A Release of Mortgage fulfills this expectation. This is a required process, as it discharges the lender’s lien on the aircraft and returns full and unencumbered title to the borrower.

If the release isn’t recorded properly, the mortgage can still appear in FAA records, and can complicate or even make impossible a later sale, refinancing, or transfer of the property. So the release is as important as the mortgage itself.

Understanding the Release of Mortgage

The Release of Mortgage is a certificate stating that the borrower has paid the aircraft loan in full without any outstanding liens, thereby releasing the lender’s registered United States Federal Aviation Administration interest in the aircraft.

Importance of the Release

- Clear Ownership: Shows the borrower is the sole owner of the asset.

- Legal Protection: Prevents disputes about past financial claims.

- Future Transactions: Makes selling, leasing or refinancing easier.

- Lender Compliance: Ensures that lenders remain compliant after receiving loan repayments.

| Element | Description | Benefit |

| Borrower Obligation | Full repayment of loan | Triggers release process |

| Lender Obligation | File release with FAA | Removes lender’s interest |

| FAA Record Update | Registry reflects ownership without liens | Provides public transparency |

| Legal Confirmation | Protects both borrower and lender from disputes | Ensures compliance with regulations |

Legal Framework and Procedures

The Release of Mortgage is governed by FAA recording requirements and by aviation finance law.

Filing with the FAA

- The lender prepares a Satisfaction or Release of Mortgage document.

- It lists the aircraft registration number, the borrower, the lender and the date the loan was completed.

- The release is then filed with the FAA Aircraft Registry.

Timing and Obligations

Lenders must file the release in a timely manner; otherwise, delays can create unnecessary complications. In fact, a late release by the lender may eventually cause ownership problems for borrowers, therefore making future transactions more difficult.

International Considerations

If operating internationally, the aircraft may be subject to treaties, such as the Cape Town Convention, in order to be internationally recognized.

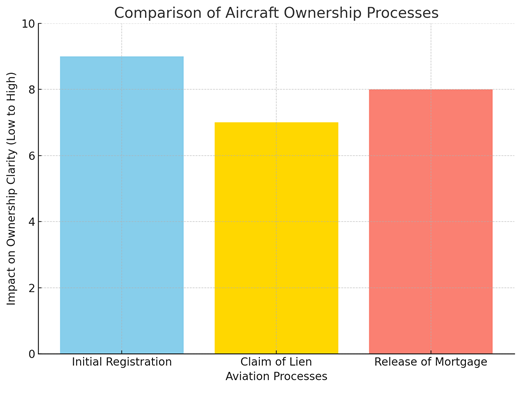

Comparing Release of Mortgage with Other Aviation Processes

Clearing liens against a property is one of several uses for a Release of Mortgage.

Release of Mortgage vs. Initial Registration

- Release of Mortgage: Releases a lender’s claim on an existing aircraft.

- Initial Registration: Establishes ownership for the first time.

Release of Mortgage vs. Claim of Lien

- Release of Mortgage: Executed when a loan is paid.

- Claim of Lien: Filed when debts and services remain unpaid.

- Initial Registration: High clarity start

- Claim of Lien: Reduces clarity

- Release of Mortgage: Restores full clarity

Practical Guide for Managing a Release of Mortgage

As a result, the borrower and lender must cooperate for the release to occur.

Confirm Loan Repayment

Borrowers should retain a copy of the last payment.

Lender Prepares Release Document

The lender will then produce a formal release, verifying the details of the aircraft and loan.

File with FAA

The signed release is then sent to the FAA Registry to update public records.

Verify Registry Update

Borrowers should check whether the FAA has updated the ownership record.

Why the Release of Mortgage Matters

At National Aviation Center, Release of Mortgage is the last step in obtaining clear title. It ensures lenders will not claim any interest and borrowers are free to sell, transfer, or refinance.

However, because a released security interest is an actual repayment of a debt and a restoration of all property rights, dealing with the lenders and ensuring FAA registration prevents further claims and ensures clear ownership of the property.