An Aircraft Security Agreement is important in the financing and ownership of modern aircraft. It provides lenders with a legal remedy without requiring the aircraft owner to part with possession. For aviation-related deals, clarity and compliance are very important; that is why this agreement provides the structure needed.

In the initial stages of aircraft financing, lenders seek assurance that their financial interest is secured. An Aircraft Security Agreement allows for a security conceivable in the aircraft as collateral. This arrangement creates trust, mitigates risk, and smoothens transactions.

Understanding this agreement is equally important for the owner. It sets out rights, duties, and possible repercussions of non-compliance. Owners may encounter surprise restrictions or enforcement without proper knowledge.

In this article, you will learn the basics, framework, comparison and other practical knowledge of an aircraft security agreement. By the end, readers will know how these agreements work in aviation law and financing.

How these aircraft security agreements can help

A directorate of the F.A.A. oversees Europe’s aircraft registry, which records the ownership of manned and unmanned air vehicles (UAVs). It does not change ownership, but it places collateral on the loan or obligation. It is an important distinction for aircraft operators who use financing.

In aviation, the assets are of high value and mobile. Lending firms have a more specific kind of risk than other industries. An agreement that has been drafted well can help in reducing these risks.

Aircraft security agreements also help in regulatory transparency. It is usually recorded to prioritize among creditors. This recording aids in avoiding disputes during resale or refinancing.

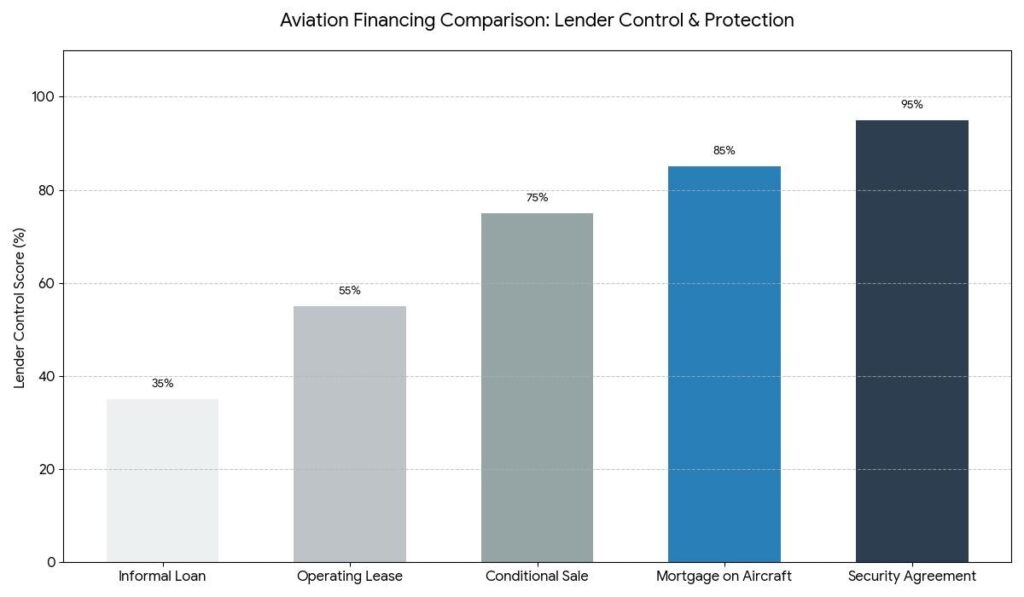

This is a comparative Table showing how this agreement differs from similar aviation instruments.

| Feature | Aircraft Security Agreement | Aircraft Lease | Bill of Sale |

| Ownership Transfer | No | No | Yes |

| Lender Protection | High | Moderate | None |

| Collateral Function | Yes | No | No |

| Financing Use | Common | Limited | Not Applicable |

This table explains why lenders prefer a security agreement to other arrangements with a financier.

Essential Elements and Legal Framework

Knowing how an Aircraft Security Agreement is designed helps lenders and owners keep their expectations and responsibilities accordingly.

The parties and secured interest

The secured party and aircraft owner must be identified. The document describes the aircraft, its serial number and registration. This prevents any confusion.

Secured Interest Describes What Obligations Are Covered They are often inclusive of repayment/interest/other charges. Enforcement rights are determined by scope.

Entitlements, Solutions, and Adherence

The contract mentions relief in case of default. Possible repossession or sale of the aircraft. These provisions enhance observance and protect the lender’s interests.

Regulatory alignment is important too. Numerous contracts make reference to aviation authority requirements. Status gives effect and recognition.

Most agreements generally have the same elements

- Specific A/C Identification

- Described the terms and repayment.

- Provisions for Defaults and Enforcement.

- Law and jurisdiction governing.

Together, these conditions form a stabilization framework for the economy.

Comparison with Other Aviation Financing Tools

Financing a jet aircraft can be done in many ways. This sentence highlights the function of the Aircraft Mortgage.

- The Aircraft Security Agreement is the best security for lenders we see. It offers lenders a control score of 95%, indicating that it offers the best legal protection for lenders to recover assets without taking away the ownership use.

- A mortgage on aircraft (85%) is highly enforceable and remains the creditor’s choice in conventional bank financing. This is due to the length and nature of the legal protection.

- An Operating Lease is the most flexible borrower option (55%) requiring the least capital upfront but provides far less security to the lender than ownership-based solutions over the longer term.

Tips for Aircraft Owners and Lenders

Effective management of an Aircraft Security Agreement requires preparedness for the unexpected. Planning ahead is good for everyone.

Essential points to consider

- Comprehend the Default Triggers

- Knowledge of recording requirements.

- Routine adherence observance.

Restrictions should be reviewed carefully by owners. Certain agreements limit resale and further liens. Awareness of the boundaries prevents offers.

Another practical checklist emphasizes long-term management

- Keep insurance as necessary.

- Maintain up-to-date registration

- Ask questions before refinancing.

- Hire an attorney before altering terms.

Following the indicated steps mitigates disputes and assists smooth financing relationship.

Being Sure: A Look Back

Aviation financing relies heavily on an Aircraft Security Agreement. It safeguards lenders, while permitting owners to gain capital without losing ownership. National Aviation Center By taking a structured approach, uncertainty in high value transactions is reduced.

Stakeholders can confidently navigate aviation financing by understanding its components, benchmarks, and real-world implications Delhi. By ensuring compliance, trust and longevity.

In the end, an aircraft security agreement contributes to the overall aviation ecosystem. It provides financial security and operational freedom to lenders as well as aircraft owners.