An Aircraft Mortgage is a loan that is secured by an aircraft and will use an aircraft. An aircraft mortgage is necessary for lenders to protect their financial interests. It also allows buyers to acquire an aircraft without paying the entire amount upfront. Aircraft financing typically makes ownership a reality for private owners, operators, and aviation companies. Grasping the workings of aircraft mortgages enables owners to avoid costly errors and violations.

Aircraft are high-value assets often associated with intricate financing arrangements. Aviation financing entails documentation and public filing unlike regular consumer loans. A mortgage creates clarity and priority rights in relation to the airplane. The lenders and buyers would not be taking risks during the transfer of ownership and in default cases where correct mortgage is not recorded.

This guide articulately and appropriately explains Aircraft Mortgage concepts. It provides great info on what an aircraft mortgage is, why it’s important, and how it differs from other aircraft security filings. Useful advice is provided to help owners and lenders make use of the mortgage responsibly. By the end, you will see how an Aircraft Mortgage can allow greater secure financing and lawful ownership of an aircraft.

Understanding Aircraft Mortgage Basics

An aircraft mortgage refers to a loan that is secured by an aircraft for collateral purposes. The borrower keeps the aircraft while the lender has a secured interest in it. A lender may exercise their rights against the aircraft if loan obligations are defaulted.

Aviation asset specific mortgage is a type of mortgage. The lender’s interest is written down and recorded in official aircraft records. Transparency safeguards both lenders and future buyers.

You can operate your aircraft daily with no restrictions under an aircraft mortgage. As long as the payments are up-to-date, the owners may keep flying the areophane. It does however, limit sales or transfer of ownership, which needs lender approval.

| Element | Aircraft Mortgage |

| Purpose | Secure aircraft financing |

| Parties involved | Borrower and lender |

| Collateral | Aircraft |

| Effect on ownership | Limits transfer until released |

Why Aircraft Mortgage Is Important

Aircraft Mortgages are vital for the financing and stability of aircraft ownership. When structured properly, they help both lenders and borrowers.

Financial Protection for Lenders

Lenders depend on aircraft mortgages to guarantee reimbursement. The aircraft is legally mortgaged to secure debt. The availability of finance is encouraged and risk on lending is reduced.

Without a mortgage on record, the lender may have limited recourse. Filing should be done properly to maintain enforceability in the event of default.

Ownership Opportunities for Buyers

Invest in Aircraft Mortgages Today A buyer may acquire an aircraft without paying 100% cash. Private ownership and business growth will be supported.

Structured finance allows payment over time. Owners can allot such resources for operations, maintenance and training.

Transparency in Aircraft Transactions

Mortgages appear in public aircraft records. This alerts buyers and lenders to existing financial interests. Transparency prevents hidden liabilities.

Clear records simplify future transactions. Buyers can confirm whether an aircraft is encumbered before purchase.

Common Situations Involving Aircraft Mortgages

- Aircraft purchase financing

- Fleet expansion loans

- Business aviation funding

- Refinancing existing aircraft

These examples illustrate the common use of aircraft mortgages. Aviation finance has an essential airplane financing.

Aircraft Mortgage Compared to Other Aircraft Security Filings

Records about the aircraft that affect ownership and financing. It is important to understand how an aircraft mortgage is different than other filings.

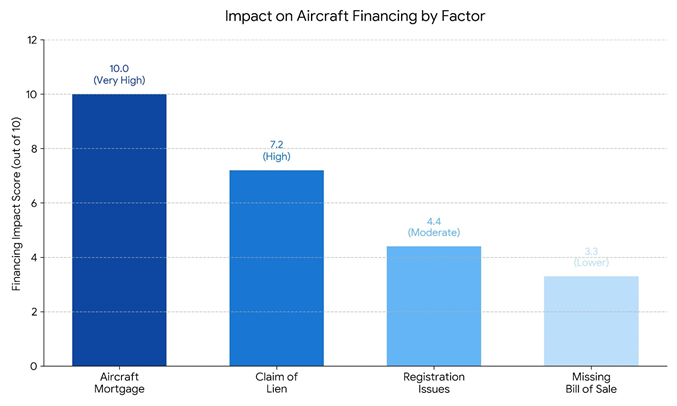

Financing Impact Comparison

- The aircraft mortgage is the most impactful financing mechanism for structuring ownership, collateral security, and repayment terms, scoring “$10.0$” on a scale from zero to ten.

- A claim of lien represents a significant funding barrier (high impact $7.2$). This is generally a new financing or refinancing that would not occur unless the debt or obligation is fully satisfied and cleared off the record.

- For regulatory issues, moderate impact ($4.4$) connoting that lenders are afraid to release funds in case the legal identity or status of an aircraft does not conform with the FAA.

Practical Tips for Managing an Aircraft Mortgage

With clear documentation, managing Mortgage should start. Before signing, you should fully understand loan terms repayment schedules and obligations. Clear communication avoids confusion.

A careful tracking of payment schedules by owners is key. Failure to pay can trigger enforcement. Managing finances can help secure your ownership.

Check mortgage on aircraft before selling or transferring it. For expungement, you generally need a release. It makes transactions seamless.

Best Practices for Owners and Lenders

- Review mortgage terms carefully

- Keep payment records organized

- Confirm mortgage release after payoff

- Check records before transfer or sale

Following these practices reduces risk. Organization ensures compliance and financial stability.

The Role of Aircraft Mortgage in Responsible Ownership

An National Aviation Center is a basic aviation financing instrument. It allows the lender to take possession of the aircraft on default. Familiarity with the payment platform guarantees stress-free and responsible ownership.

This aircraft mortgage analysis explains what an aircraft mortgage is and why it matters compared to other aircraft filings. Some tips were provided to owners and lenders on managing the mortgage. Knowledge mitigates risk of loss.

A properly handled Aircraft Mortgage ensures profitability for the owner as well as flexibility. Good records, proper payments and good releases ensure compliance. In aviation finance, a properly structured mortgage can support development, security, and longevity.