The aircraft mortgage filing process is essential to obtaining financing for aircraft purchases and refinancing. When a lender lends money for an aircraft, the filing of the mortgage creates a legal interest in the aircraft as collateral. The lender is protected, and there is transparency in the official aviation records.

Aircraft owners, lenders, and investors must understand this process. A properly filed aircraft mortgage will be enforceable and will take priority over competing claims and will assist with future transactions. A filing that is inaccurate or is not completed may result in delays and disputes. It could also result in ousting the security interest of the lender.

The process of filing an aircraft mortgage is not merely paperwork. It requires a high level of precision to comply with regulatory standards. Each sign, signpost, and document, is important. Aircraft are high-value assets, and even minor filing errors can have serious consequences.

This guide explains the aircraft mortgage filing process, its significance, how it relates to other filings, and how to complete it processes correctly. There are best practices stakeholders can follow which can protect their interests.

Why You Should File a Mortgage on Your Aircraft?

An aircraft mortgage filing formally records a lender’s security interest in an aircraft. This mortgage notice serves to inform the public that the aircraft is encumbered.

Essentially, there are three links to the process. The lender, the borrower and the aircraft are stated. In order for the mortgage to be enforced, all 3 must be correctly identified.

Loans against aircraft are not just like loans against other personal property. The documentation standards of the aircraft Leasing must be centralized. This allows for uniformity in ownership, financing and transfer.

| Component | Description | Purpose |

| Mortgage Agreement | Legal contract between parties | Establishes debt terms |

| Aircraft Identification | Serial number and model | Confirms collateral |

| Parties Information | Borrower and lender details | Defines legal roles |

| Filing Record | Official mortgage entry | Protects lender interest |

An appropriate filing process for aircraft mortgages generates clarity, priority, and security.

Importance of Aircraft Mortgage Filing Process

Importance of aircraft mortgage filing process is more than just a formality. It impacts rights of ownership, security for financing and efficiencies of transactions.

By filing, lenders establish priority Whoever files the first claim will have better claims than others in case of multiple claimants. A lender’s interest may be challenged without the proper filing.

When aircraft owners file mortgage, it provides order. This clearly defines the parties’ obligations to each other and prevents misunderstandings during the sale or refinancing of the property. During due diligence buyers and financiers rely on the records.

Accurate filing facilitates transparency from a compliance angle. It provides information regarding the aircraft’s financial standing to those interested in it.

Proper Mortgage Filing Has Its Advantages

- Safeguards lender’s security right.

- Sets claim precedence.

- Facilitates clear transactions.

- Makes the legal environment clearer.

Consequences of Wrong Filing

- Lien Priority Loss

- Postponed selling or refinancing.

- Conflicting ownership assertions.

- More legal liability.

These factors indicate the importance of accuracy in the aircraft mortgage filing process.

A Review of Aircraft Mortgage Filings

The filing of aircraft mortgages is frequently confused with other aircraft records activities. Every single one serves a different purpose and means something else.

Aircraft Record Filings

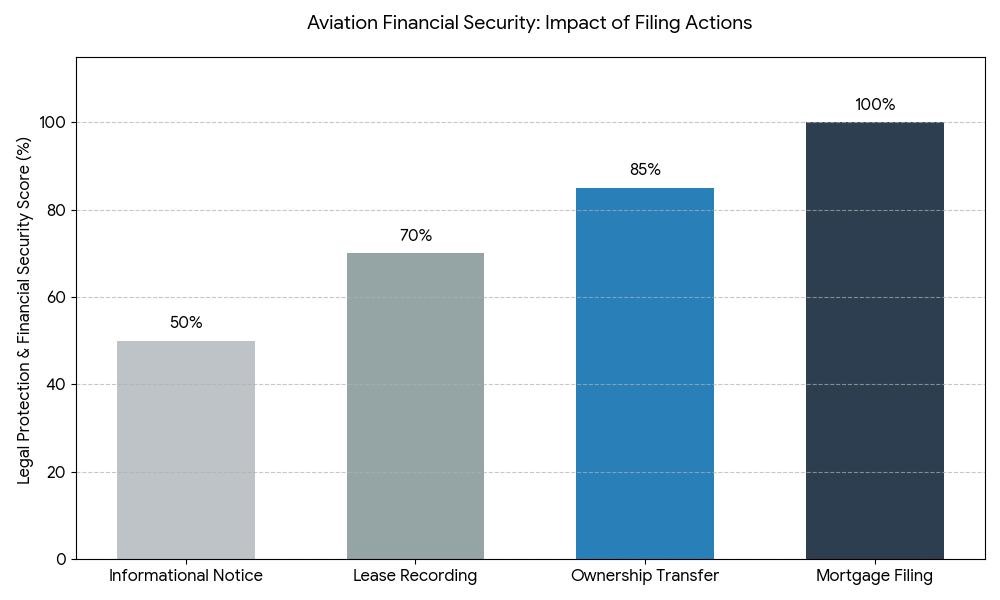

- Mortgage filing scores a perfect 100% in relation to lenders because it creates a perfected security interest which is binding on the third parties that ensures priority upon default.

- The dominant legal control used to effect a change in the registered owner is Ownership Transfer (85%) which is a very well-known agreement. While Ownership Transfer (85%) does confer a strong legal standing, it is only indicative of the equity position and not the exact security interest of a financier.

- The mechanism Lease Recording (70%), which serves to protect the rights of the lessee and inform the public as to who is in operational control of the aircraft, enjoys strong administrative protection for the day-to-day operation.

A process of filing aircraft mortgage in detail

By knowing each stage of the airplane mortgage filing process allows for fewer mistakes and setbacks.

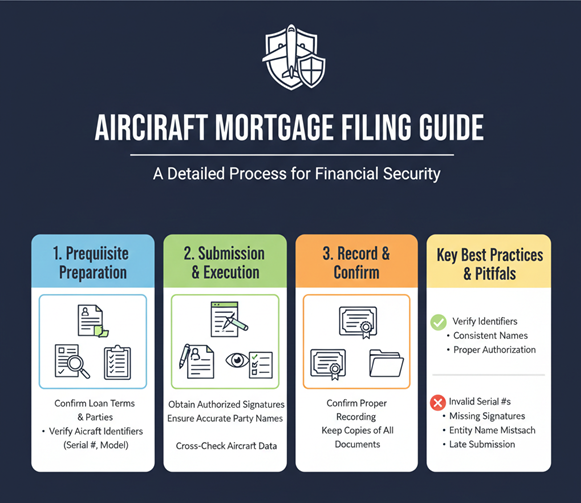

Prerequisite Preparation

The parties must confirm the loan terms, details of the aircraft, and authority to sign.

Identifying the aircraft correctly is crucial. The serial numbers and model designations must exactly match the records. Little inconsistencies can expose you to rejection.

Submitting and filing Execution

- Upon completion of the draft, the filing proceeds in an orderly manner.

- Obtain authorized signatures on the mortgage deed.

- Please ensure that borrower and lender information is accurate

- Check aircraft identifiers against existing records.

record your mortgage

You must confirm after submission. The parties should ensure they properly record the mortgage.

Keeping copies of all filed documents will aid future business transactions and evaluations.

A pair of lists summarize best practices and mistakes

- Best practices for successful filing.

- Verify aircraft designators.

- Use the same party names.

- Get the right permission.

Acknowledge receipt of papers

- Frequent Issued Defects.

- Invalid sequence numbers.

- Signatures absent.

- Inconsistent names of entity.

- Late Submission.

Real-life Examples and Legalities

The financing process within real transactions is often shaped by the aircraft mortgage filing. Envisage a lender funding an aircraft acquisition. If the parties do not file properly, third parties may not be able to enforce the lender’s interest.

Buyers check the mortgage records carefully. If parties do not file mortgages correctly, they can slow closing or require corrective filings. This creates more expenses and doubt.

Refinancing poses similar challenges. New lenders usually want confirmation of existing mortgages and their priority. The process is simplified with accurate filing.

The aforementioned scenarios illustrate how the filing of a mortgage impacts the long-term operation and valuation of an aircraft.

filing an aircraft mortgage successfully

The process of filing an aircraft mortgage protects the lender and provides clarity to the owner. It creates legal security, encourages transparent transactions and safeguards a financial interest.

You can avoid common missteps by learning the steps, preparing accurate documentation and verifying your filings in a timely manner. Each phase requires meticulous attention and consideration.

Loan filing may be a procedural matter, but it is still significant. National Aviation Center you treat it as a priority, the financing, transfer and future dealings are smoother.

Engaging in a well-executed aircraft mortgage filing process ultimately instils confidence, mitigates risks and promotes stability in aviation transactions.