The mortgage a crucial step to complete the lifecycle of Aircraft Financing. A Release of Mortgage is an official document that states that the loan on an aircraft has been discharged in full and that the lender has no further secured interest in the aircraft. For owners of an aircraft, it is just as important as the initial financing. If a release is not properly recorded, an aircraft could continue to appear encumbered after full payment of the loan.

Most owners think that just the payment will clear everything. In truth, finances and public records are two different things. Until recorded, the mortgage can be seen in official aircraft documentation. You may face significant difficulties when selling, refinancing, or transferring ownership.

This comprehensive guide illustrates Release of Mortgage in a clear and practical manner. This explains what a release is, why it is important, and how it compares to other aircraft record filings. You will also have tips to get the job done properly. At the end, you will learn how a Release of Mortgage protects your aircraft’s title and verifies clear ownership.

Understanding Release of Mortgage

Though an aircraft loan may be secured by a mortgage, the lender will release this mortgage upon full satisfaction of the loan. It declares the lender’s secured interest in aircraft has been discharged or satisfied. This document deletes the aircraft mortgage from the public register.

Payments stopping do not automatically result in release. It has to be properly executed and recorded. Until that moment, the mortgage remains an open encumbrance.

It protects owners as well as buyers in the future. It confirms that the aircraft is free of all financial claims. Having clear record of the transactions shows transparency and helps in avoiding any confusion and litigation.

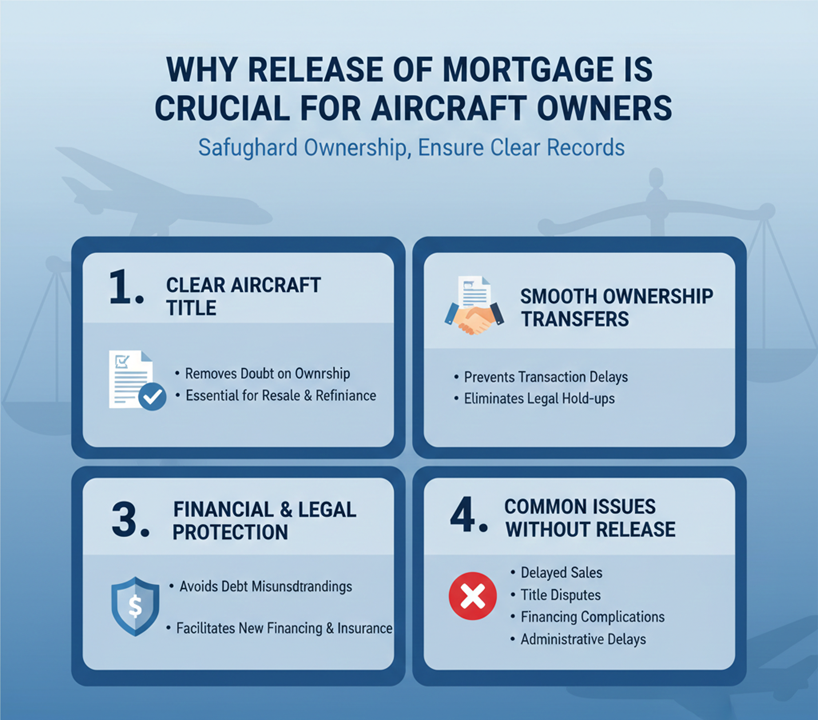

Why Release of Mortgage Is Important

A release of mortgage is important to safeguard ownership rights and keep accurate aircraft records. Its importance goes beyond administrative formality.

Clear Aircraft Title

If a mortgage is not released, the title to an aircraft may be clouded. This causes doubt regarding ownership rights. A release indicates that the aircraft is not subject to that particular liability.

A clear title is crucial for any resale, gift or refinance. Buyers and lenders want assurance there is no outstanding mortgage.

Smooth Ownership Transfers

Pending mortgages can hold up or stop a transaction when selling or transferring a plane. Owners must provide a record showing that they have paid the loan.

A recorded release clears up doubt. Transactions can go through without unnecessary hold-up to a legal review.

Financial and Legal Protection

If owners do not record a release, others may contest their ownership. They could assume a legacy debt still exists for the affected parties. Proper release documentation can prevent such misunderstandings.

Clear records may also be used to arrange financing and insurance. Accurate Documentation provides Financial Protection.

Common Issues without a Recorded Release

- Delayed aircraft sales

- Title disputes

- Financing complications

- Administrative delays

These issues show why release recording should never be overlooked. It is a critical final step.

Release of Mortgage Compared to Other Aircraft Filings

Aircraft records include several filings that affect ownership and financing. Understanding how a release differs from other documents is important.

| Filing Type | Purpose | Status Impact |

| Aircraft Mortgage | Secure loan | Creates encumbrance |

| Release of Mortgage | Remove encumbrance | Clears record |

| Claim of Lien | Secure unpaid debt | Creates encumbrance |

| Registration | Establish ownership | Required for operation |

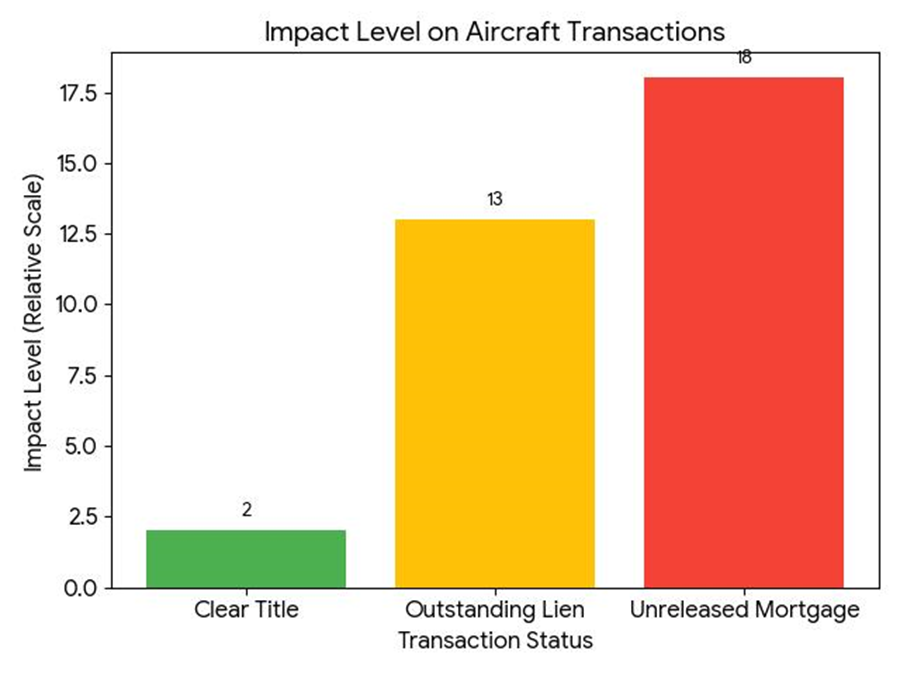

Impact on Aircraft Transactions

- An unreleased mortgage presents the most significant problem (Impact Level 18) and can stall a transaction completely until the legal record clears.

- Outstanding liens leave a high impact (level 13) and require a lot of administrator efforts and verification before sale can take place.

- A clear title, rated Level 2 for impact on the transaction, ensures smooth and fast transfer of ownership.

Practical Tips for Completing a Release of Mortgage

Clear communication is the key to managing a release of mortgage. Once paid, check with your lender on their release process. It’s not to be taken for granted.

Please confirm the payoff and release in writing. Maintain Copies Of All Documents. Documents clearly laid out make transaction easy for the future.

Check if the release has been recorded properly. This is for checking the record for the mortgage no longer appears.

Best Practices for Aircraft Owners

- Confirm payoff with the lender

- Request release documentation promptly

- Retain copies of release records

- Verify removal of mortgage from records

Following these practices ensures clean title status. Attention to detail protects ownership rights.

Finalizing Ownership With Release of Mortgage

When aircraft financing closes, the owner completes the Release of Mortgage as the final step. This statement confirms that the owner has fulfilled the financial obligations and clears the aircraft’s public record. Realizing the value of this can save owners money and time.

The guide explained what a Release of Mortgage at National Aviation Center is, why you need it and how it compares to other aircraft filings. Owners were provided with practical guidance to manage the process. Appropriate knowledge ensure smooth ownership transfer.

Aircraft owners should timely complete and record a Release of Mortgage in order to protect their investment and flexibility in the future. If records are clear, you can confidently resell, refinance, and own long-term the vehicle. Release is compulsory in aviation financing. It is necessary.